Despite some optimistic estimates on the market downturn trending upward for the second half of the year, the worldwide economy remains sluggish due to inflation and interest-rate hikes. The buying power for ICT products, like mobile phones or notebook computers, is tentative, resulting in weak demand that further worsens memory pricing. The silver lining of this cloudy market is the increasing attention toward AI related applications that require large amount of computing power and cloud storage to process data. This segment could drive more growth on industrial servers.

Here are some price updates and market outlooks for major applications in memory market.

Server Market

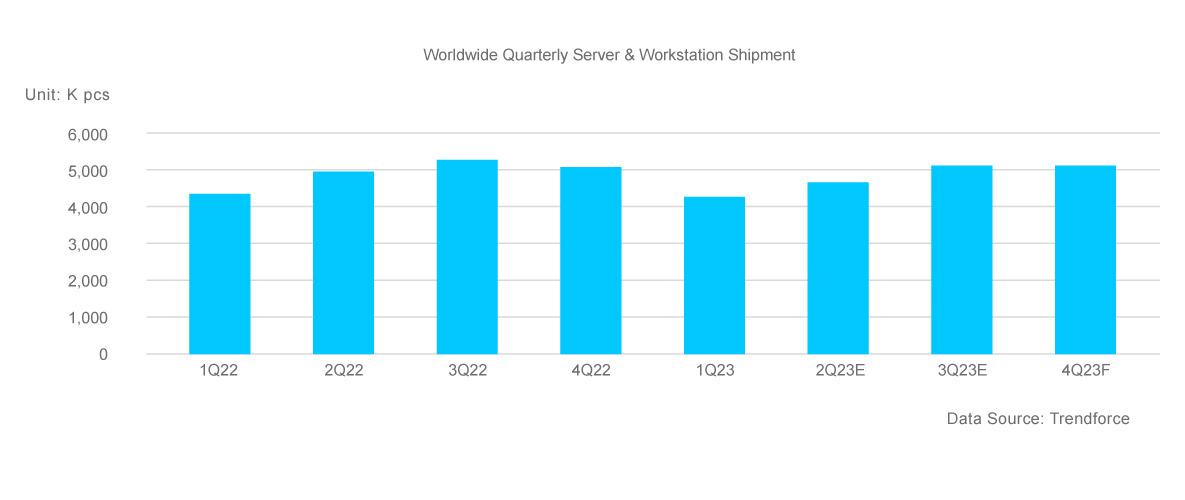

- More than 5% QoQ reduction in Q2, 23’ server shipments. The overall market remains subdued, with a single-digit decline in revenue during Q3. No obvious factor indicates the increase in shipments.

- However, expected recovery could be faster than estimated with a two digit growth in sales during late Q4, 23’ thanks to robust demand for virtualization, advance data intelligence and AI products.

PC/NB Market

- The spot price experienced a temporary increase for less than a week at the end of May, primarily due to factors such as production cuts by chip makers and China's ban on specific US chip manufacturers. The impact was more significant in the PC/NB segment, while the server/mobile market remained unaffected.

- Quantity of PC/NB DRAM shipment has experienced a 7% decline compared to the previous quarter. The market is still under inventory pressure resulting from mid-stream (NB OEM) and original suppliers. The contract price and spot price have repeatedly intersected since last May and this pattern is expected to persist throughout in Q3, 23’.

Mobile Market

- Smartphone shipment quantities have shown gradual signs of recovery in Q2, 23’ with 7% QoQ increase after a historical low in Q1. However, whether the growth can continue remains uncertain in upcoming quarter.

- The decline in the mobile market was driven by a number of factors, especially on-going inflation, resulting in delaying or cancelling consumers’ device upgrades to their smartphones and tablets.

Q3 Outlook in DRAM

- For Server DRAM, a negative sufficient ratio is expected with during late Q3, 23’ as CXL technology benefits memory coherency between the CPU memory space and memory on attached devices. The most attractive factors of CXL protocol are reducing software stack complexity and to lower overall system cost.

- Graphic DRAM may boost the demand in the second half of 2023 as its various support in AI related applications which will benefit the DRAM suppliers in consuming high inventory.

Q3 Outlook in NAND

- Slump in both volume and price may lead to global enterprise SSD revenue falling by nearly 50%.

- MLC production would decline more than 20% in 2023 compared with last year. pSLC mode on TLC solution would be the cost effective choice for high-end applications in server and IPC industry.

- Among various applications, enterprise SSD and mobile stands out as the primary and substantial source of bit consumption in Q3, 23’.

*The article was complied by SMART Modular using data source from market report by DRAMexchange & SPOT market reference, Taipei TIMES, BBC, Trendforce and Digitimes.